Redefine how lenders, investors, and servicers move through post-closing, lien release, and assignment workflows – faster, cleaner, and with fewer handoffs.

Is your post-closing file taking too long to get audit-ready?

Automate your post-closing workflows for faster, compliant, audit-ready delivery in under 15 mins.

Post-closing operations are the backbone of mortgage servicing and loan delivery—but they’re also one of the most resource-intensive. Manual processes from chasing down documents to re-keying data create a cascade of problems. They're not just inefficient; they are a major source of risk, increasing your exposure to human error, compliance violations, and missed deadlines.

Manual stacking, classification, and auditing can consume over half of operations capacity, forcing your team to react to problems rather than proactively managing them. The result is a cycle of fire-drills that drains resources and prevents you from focusing on growth.

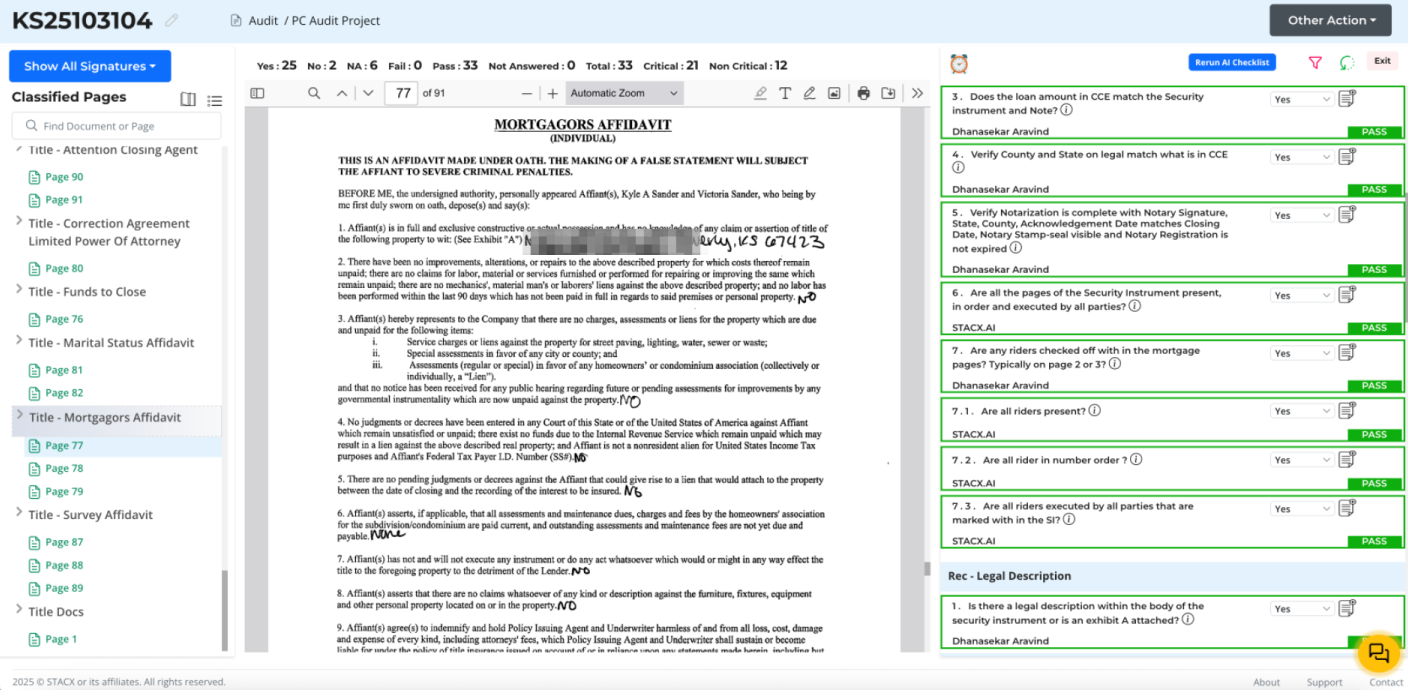

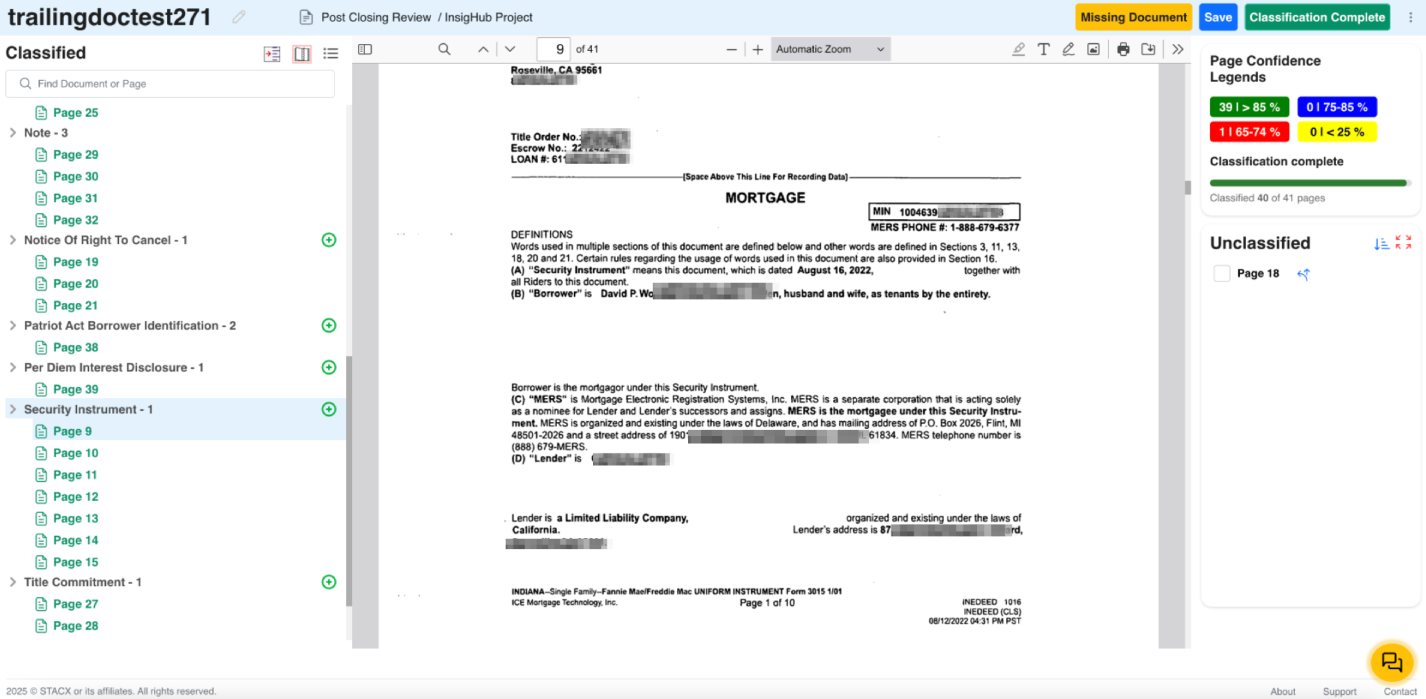

STACX was built to solve this. Our platform eliminates the manual work that holds your team back by automating the entire post-closing workflow, from document ingestion and classification to stacking, auditing, and delivery. We provide a unified system that operates with speed and precision, allowing your team to shift their focus from repetitive tasks to high-value work.

With STACX, mortgage teams can:

Automatically process contracts, post-closing files, loan packages and forms in real-time while keeping your team focused on the customer experience

Unlock Hidden Value with STACX: STACX is a cutting-edge platform that uses AI and machine learning to unlock valuable data hidden within unstructured real estate documents. With our powerful algorithms, you can easily extract important information from documents like title deeds, mortgage agreements, and more.

Our intelligence engine doesn’t just “read” documents — it understands them. STACX applies

domain-trained AI and machine learning to classify, extract, and validate information from the

most complex mortgage files, whether scanned, imaged, or handwritten.

By combining contextual recognition with rule-based checks, STACX ensures accuracy where

generic OCR tools fall short. The result: cleaner data, faster exception handling, and

investor-ready files — all with a very minimal manual intervention.

1 st

2 nd

3 nd

4 rd

5 th

6 th

Powered by STACX, driving measurable results

AI-powered automation for stacking, auditing, and investor delivery.

Explore moreYour data is our priority. STACX is built with industry-leading security protocols and robust compliance features to protect sensitive information and adhere to regulatory standards.

Our dedication to security means your data is always protected with us. We ensure our platforms meet rigorous industry standards, providing the confidence and peace of mind you need to focus on what matters—your business.

Ready to eliminate your post-closing backlog?

© 2025 Avanze Tech Labs Inc. All rights reserved.