AI-powered document automation that accelerates lien release and assignment processing while ensuring accuracy, compliance, and investor-ready results.

Don’t have high volumes? No problem.

Access LienFree — a simple, pay-as-you-go lien release solution. Perfect for low-volume or one-off needs.

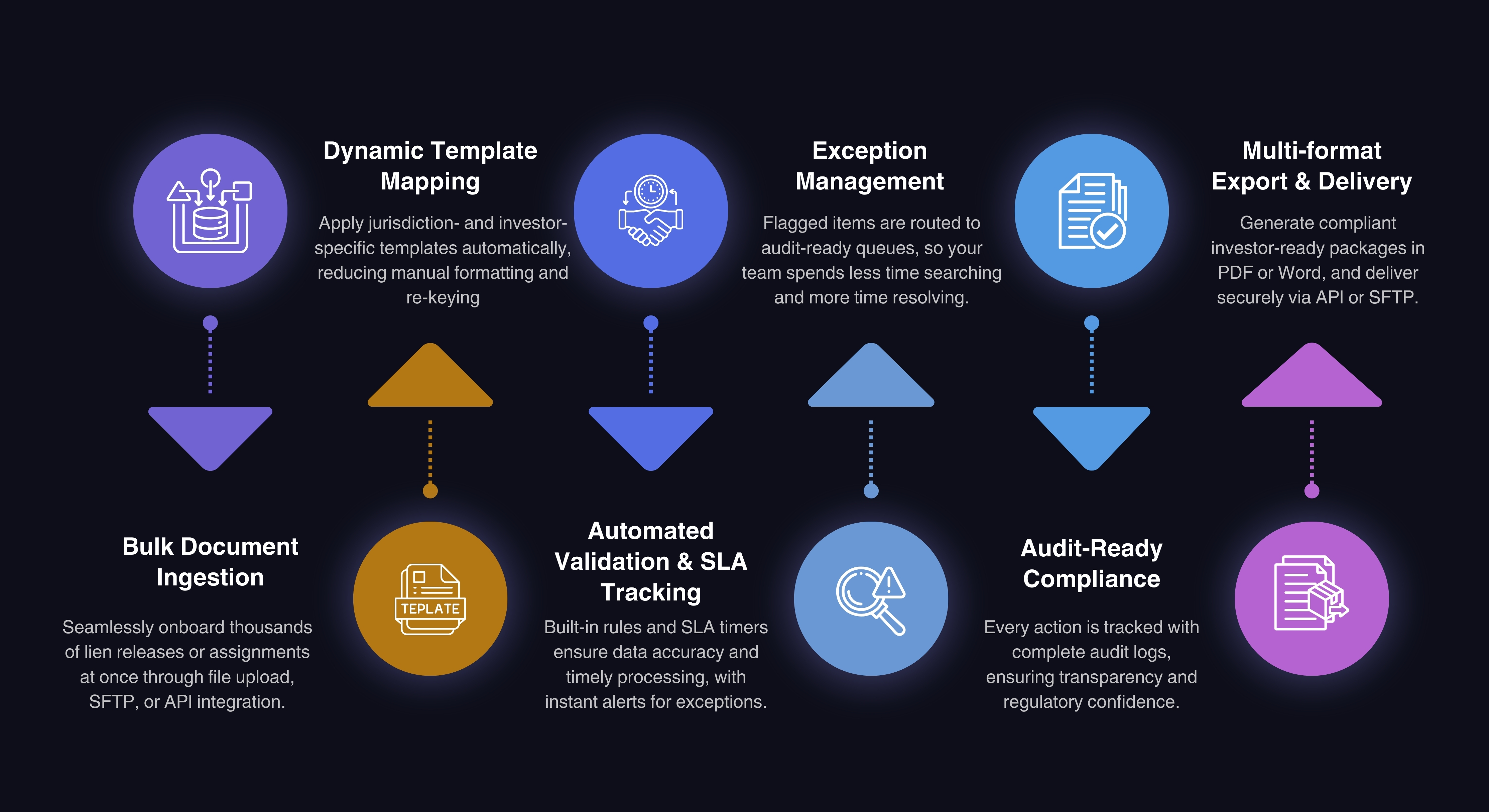

Lien releases and assignments are mission-critical in loan servicing, yet most organizations still rely on manual, error-prone processes. From creating jurisdiction-specific templates to re-keying borrower and loan details, every step introduces the risk of delays, inaccuracies, and compliance violations.

What should be a straightforward process often becomes a bottleneck—slowing investor delivery, straining operations teams, and exposing institutions to regulatory scrutiny. Manual exception handling, formatting, and multi-format exports can consume days of effort and make it difficult to scale efficiently.

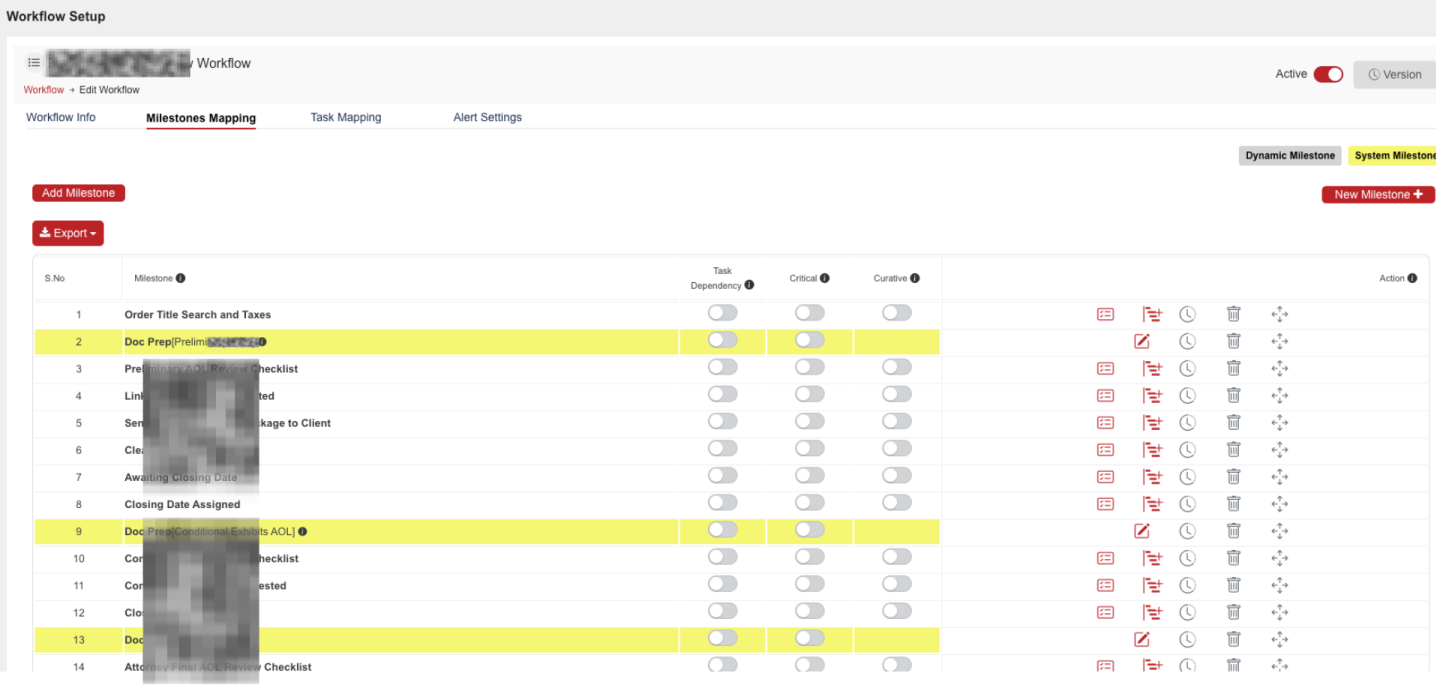

MAX was built to eliminate these inefficiencies. By combining AI-driven automation with dynamic templates and compliance-ready workflows, MAX simplifies the entire lien release and assignment lifecycle—from data intake to recording and delivery.

Instead of chasing errors and formatting issues, your team can rely on MAX to ensure speed, accuracy, and investor compliance—every single time.

With MAX, mortgage and servicing teams can:

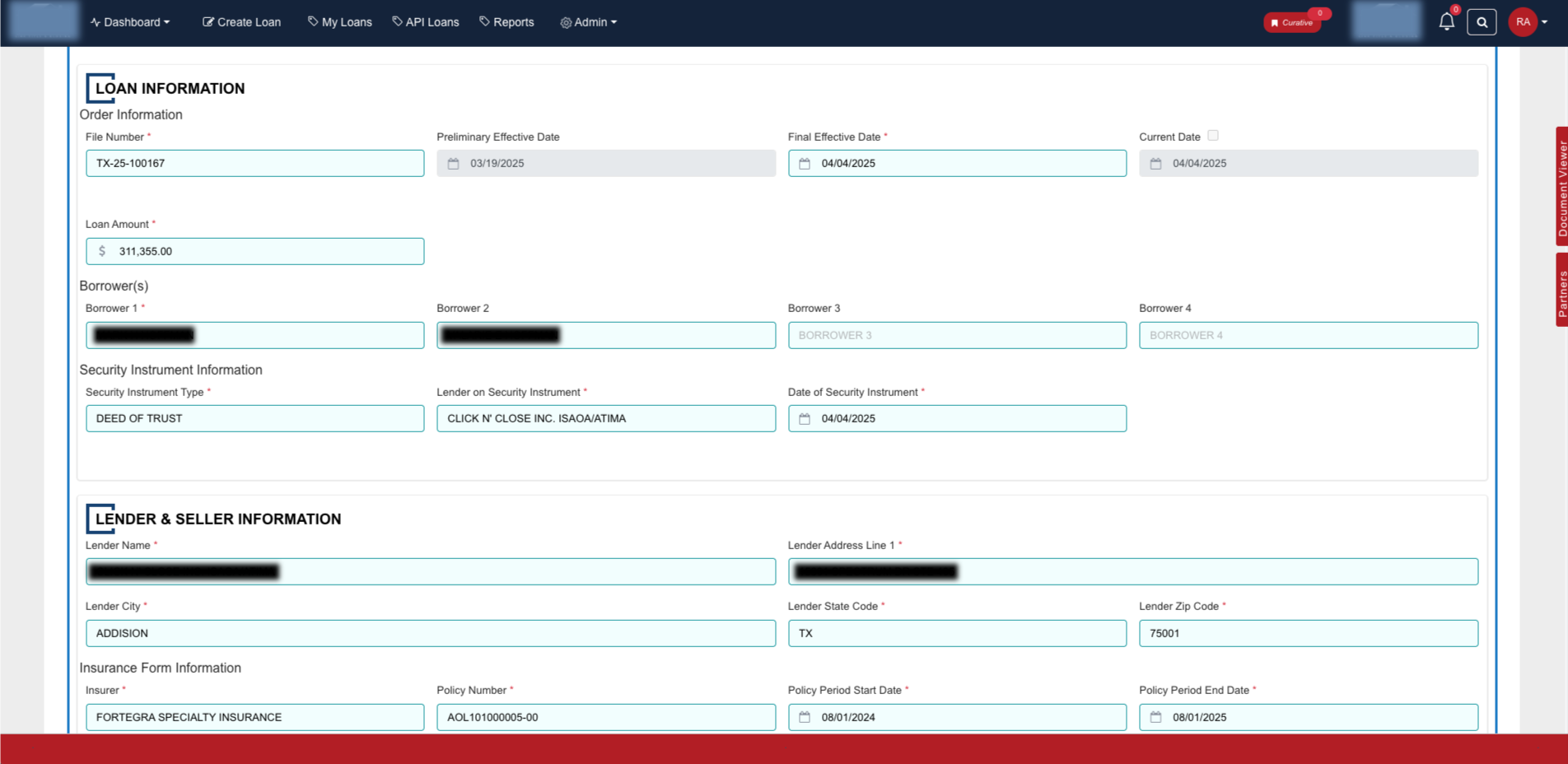

MAXLien, the revolutionary platform for Assignment and Lien Release tracking and document generation. With MAX, you can streamline your workflow and take control of the assignment and lien release process like never before

MAX makes it easy for hybrid teams to track, generate, and work on any device and from anywhere. Plus, it’s easy to scale—deploy new users and global offices in minutes.

MAX doesn’t work in isolation — it connects with STACX to handle unstructured documents. Whenever a workflow requires data from scanned loan files, STACX automatically extracts, classifies, and validates the content before passing it into MAX.

This integration ensures every MAX-driven workflow starts with clean, reliable data — so dynamic templates, rules, and investor-ready outputs are always accurate. By combining STACX’s document intelligence with MAX’s workflow automation, teams eliminate data silos and maintain a continuous, end-to-end process.

1 st

2 nd

3 nd

4 rd

5 th

Powered by STACX, driving measurable results

MAX is built with compliance-first design: encryption, jurisdictional templates, and audit logs ensure end-to-end integrity of all generated documents.

Ready to simplify investor-ready document generation?

© 2025 Avanze Tech Labs Inc. All rights reserved.