Digitize and automate your post-closing workflows with AI-powered accuracy, real-time compliance tracking, and faster investor delivery.

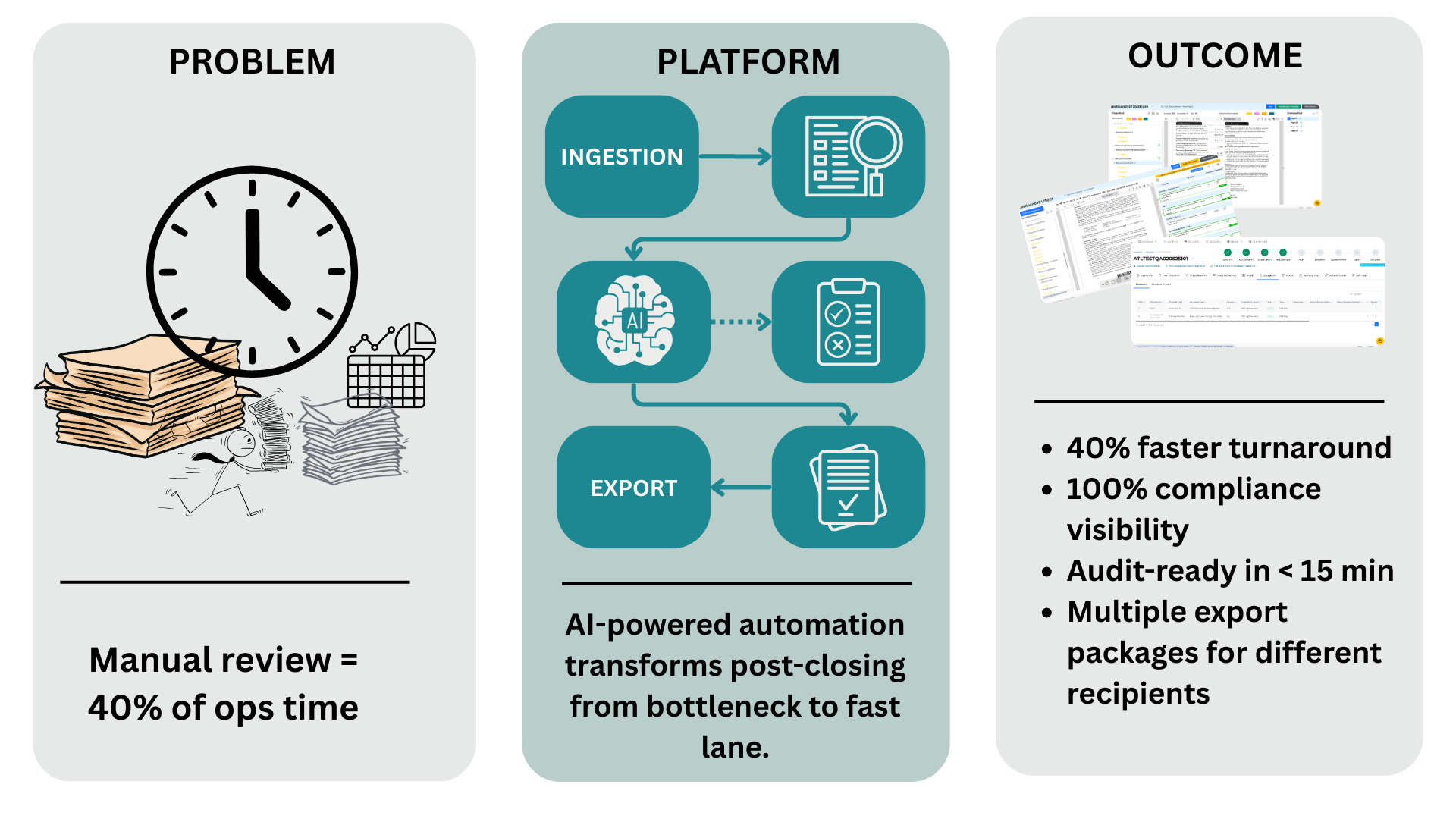

Post-closing teams face relentless operational pressure. Manual document review, stacking, and audit consume up to 60% of staff time, while SLA violations can lead to investor penalties, poor scorecards, and compliance risk. Packages often arrive incomplete or in inconsistent formats, slowing down investor delivery and increasing cost per loan.

ATL’s Post-Closing Automation uses our STACX platform to process, classify, validate, and prepare loan packages in minutes — not days. Our AI-powered automation ingests mixed-format documents, stacks them according to investor rules, flags exceptions instantly, and produces ready-to-deliver export packages with complete audit trails.

Whether you’re processing hundreds or thousands of loans a month, STACX scales without adding headcount while improving compliance visibility and turnaround times.

Detects and organizes docs in seconds.

Applies investor-specific stacking orders automatically.

Pinpoints missing or incorrect documents before delivery.

Full audit-ready package in under 15 minutes.

Deliver in investor, custodian, or internal formats.

Track progress and resolve issues before deadlines.

Easy access for compliance and re-audit.

1 st

2 nd

3 nd

4 rd

5 th

6 th

7 th

8 th

Our Partners

Ready for audit-ready post-closing packages in minutes?

© 2025 Avanze Tech Labs Inc. All rights reserved.