We don’t just build tools — we build velocity. Our platform

redefines how lenders, investors, and servicers move through

post-closing, lien release, and assignment workflows — faster,

cleaner, and with fewer handoffs.

Business Revenue

Our solutions scale seamlessly as your business grows while

ensuring enterprise-grade security at every step.

Business Revenue

From leveraging AI to automation, we continuously

innovate to keep your business ahead of the curve.

Business Revenue

For over the last 10 years, we've delivered powerful, customizable platforms that address key challenges in post-closing, document management, loan modifications, and more. We bring precision, speed, and control to your operations — helping you stay compliant, efficient, and future-ready.

AI-Driven Automations

Unmatched Expertise

Partnership-First Approach

Streamline post-closing with AI-powered stacking, indexing, auditing,

and exception handling.

Key Highlights

40% Cost Savings by reducing manual intervention

60% Faster Turnarounds with automated workflows

Seamless Integration with OCR, LOS & servicing systems

Audit-Ready in < 15 mins through exception-driven review

Solutions

Create compliant, investor-ready documents with dynamic templates and workflow automation.

Explore MAXKey Highlights

Real-Time Validation to catch errors before document delivery

End-to-End Workflow Automation minimizing manual touchpoints

Customizable Templates tailored to investor and client requirements

100% Compliance Visibility across generated docs

Solutions

Automate the intake, verification, and delivery of post-closing documents to investors, custodians, and other stakeholders — reducing turn times and improving compliance tracking.

End-to-end solution for preparing, validating, and delivering lien release documents with jurisdictional compliance and complete audit trails.

Leverage cost-effective, compliant Attorney Opinion Letters (AOLs) as an alternative to traditional title settlement for qualifying loans — backed by legal oversight and automation.

Extract key data fields from Closing Disclosures with precision using intelligent OCR and rule-based validation — enabling faster onboarding, QC, and downstream processing.

Automated tracking, exception handling, and delivery of trailing documents — ensuring timely completion of the post-closing package and investor delivery.

Eliminate manual title search inefficiencies using intelligent automation — integrating with county systems and third-party data sources to deliver accurate results faster.

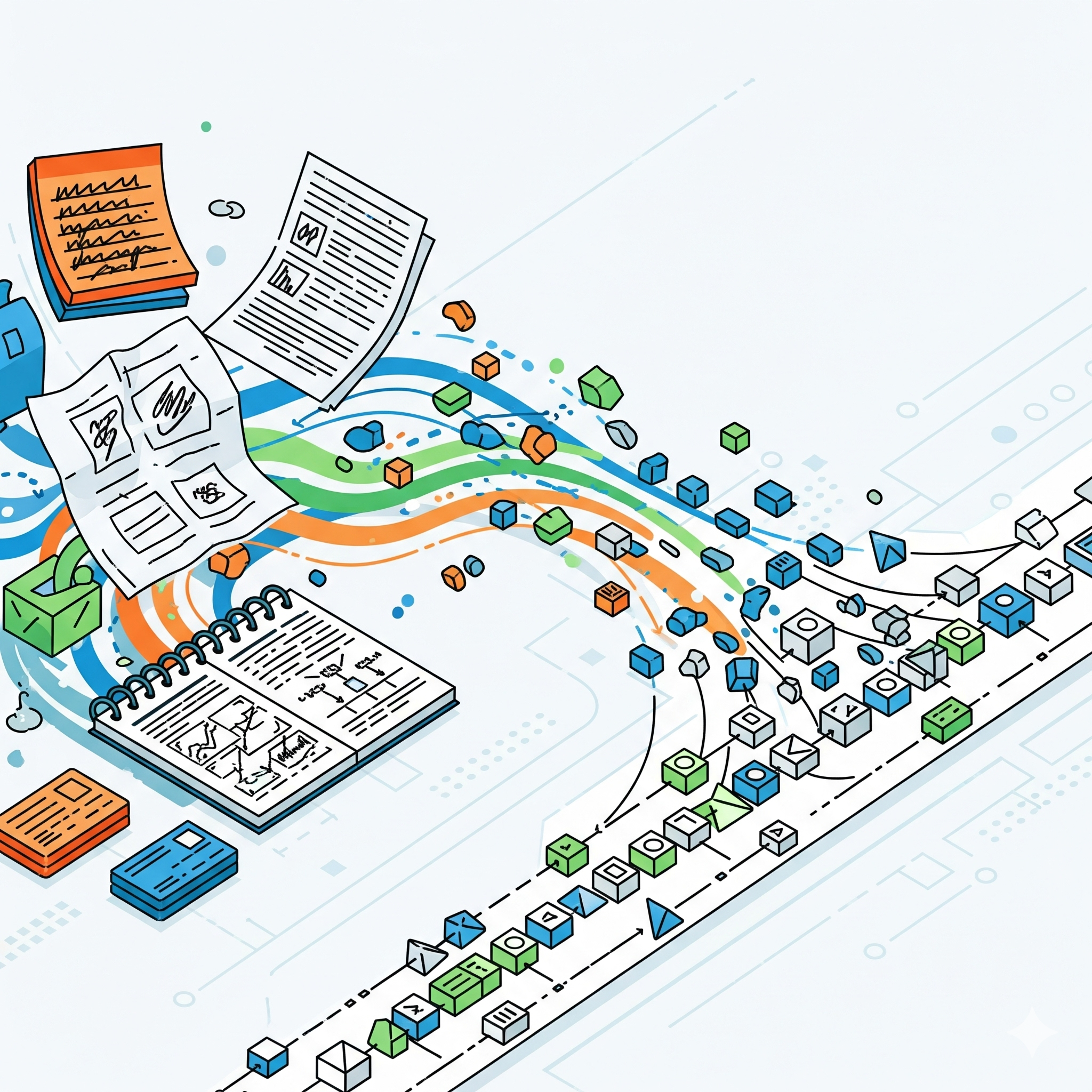

Built specifically for mortgage workflows, investor rules, and compliance needs.

AI models convert unstructured documents into structured data, eliminating manual effort.

No-code workflows let you define custom milestones and automation rules on the fly.

Handles high volumes securely with enterprise-grade encryption and full audit logs.

A powerful post-closing engine that automates auditing, classification, and exception management — helping mortgage teams eliminate manual review, speed up processing, and scale operations from Loan Setup to MSR Transfers.

Learn More

A flexible document preparation and workflow platform that streamlines lien releases, assignments, and investor-specific configurations — helping mortgage teams replace manual spreadsheets, improve accuracy, and adapt quickly with no-code automation.

Learn More

A title search and document abstraction platform that simplifies how mortgage companies place and process title orders — combining intelligent automation with expert review to deliver structured, reliable data for due diligence, underwriting, and asset reviews.

Learn More

A flexible document preparation and workflow platform that streamlines lien releases, assignments, and investor-specific configurations — helping mortgage teams replace manual spreadsheets, improve accuracy, and adapt quickly with no-code automation.

View Project

A title search and document abstraction platform that simplifies how mortgage companies place and process title orders — combining intelligent automation with expert review to deliver structured, reliable data for due diligence, underwriting, and asset reviews.

View Project

Tailored solutions for lenders, servicers, and title companies—deeply aligned with your domain-specific needs.

Deploy on ATL Cloud or your own AWS infrastructure, with accelerated go-live timelines and minimal disruption.

Collaborative onboarding and continuous enhancement ensure your workflows evolve with your business goals.

Our Partners

“ATL Team accomplished what others tried hard over a period of two years in less than a month”

Manager at Title Agency

“We appreciate all ATL support in preparing to go live with this project. We are excited for this software to improve our post-closing workflow.”

Post Closing Manager at Title Agency

“We are so happy and delighted with STACX that we take pride in referring the product to our friends in the industry”

SVP Post Closing at National Title Agency

“The seamless integration between MAX and STACX has transformed how we handle loan modifications and post-closing audits. What once took days now takes hours.”

Director of Operations at Mortgage Services Firm

Your message has been sent successfully.

© 2025 Avanze Tech Labs Inc. All rights reserved.